Stephanie Ferguson

Stephanie Ferguson

Director, Global Employment Policy & Special Initiatives, U.S. Chamber of Commerce

Isabella Lucy

Isabella Lucy

Graphic Designer, U.S. Chamber of Commerce

Published

May 25, 2023

Small business drives the U.S. economy. Small businesses employ nearly half of the entire American workforce and represent 43.5% of America’s GDP. They are a critical part of our economic ecosystem where big businesses and small businesses are vendors, employees, partners, and customers to each other.

This data center includes facts, statistics and data visualizations about small businesses’ contributions to the economy and the unique challenges that Main Street businesses face.

Small businesses fuel the economy.

- 99.9%of businesses in the U.S. are small businesses

- 33.2MSmall businesses in the U.S.

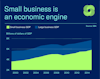

For the past 20 years, small businesses have accounted for roughly 40% of the United States’ gross domestic output (GDP), which equates to trillions of dollars of economic activity. In 2014, small businesses generated nearly $5.9 trillion. By comparison, large businesses generated $7.7 trillion to the national GDP that same year.

Small businesses are big employers.

- 46%of Americans are employed by a small business

- 62MAmericans employed by small business

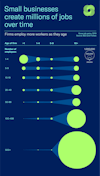

Although most small businesses (80%) have no employees, small businesses provide work to almost half of the American workforce. The chart below shows how businesses create millions of jobs overtime. For example, all of the small businesses that employ between 10-19 employees collectively add more than 500,000 jobs to the U.S. economy over 10 years. And small businesses pay big. On average, small businesses pay employees $30.42 an hour, which amounts to a $63,000 income over the course of a year.

- 12.9MJobs created by small business 1996 – 2021

- 5.5MSmall business jobs created after the pandemic recession

Small businesses are innovative.

Small business owners who are making meaningful contributions to the economy and job creation also embody the spirit of American innovation and entrepreneurship.

Entrepreneurship has been booming in the years following the COVID-19 pandemic. In 2021 alone, a record breaking 5.4 million new business applications were filed, and nearly as many 5.1 million were filed in 2022.

Explore our interactive map below tracking the latest data on the surge in entrepreneurship in each state and county across the country.

New Business Applications by State

Click on a state for more details.

Even before the pandemic, SBA data shows small businesses historically applied for a large portion of patents. Businesses with 5-9 employees received more patents per employee than any other business, and nearly double the patents received by large businesses in 2016. That same year, micro employers (1-4 employee) applied for more than 270 patents per employee, or 10% of all patents applied for that year.

Small businesses are suppliers, vendors, and customers.

Small businesses are a vital part of the supply chain. When invoices aren’t paid promptly, the small business must cover the outstanding revenue through additional lines of credit. Financing options that provide a bridge for small suppliers ultimately cost the business more money, minimizing their profit.

Unfortunately, late payments are frequent. On average, half of all invoices are unpaid by the due date. The U.S. Chamber’s Prompt Pay Pledge urges companies to pay their small suppliers and vendors quicker.

Small business ownership is diverse.

The innovation and diversity of small businesses is a reflection of the entrepreneurs behind them. Almost half of all small business owners are women, and four in 10 of all small business owners are foreign-born.

One in five are owned by racial minorities, with Hispanics making up a large portion of that number. In fact, according to the SBA, Hispanics owners are behind one in every four new businesses. Altogether, Hispanic owned businesses pay more than $100 billion in annual payroll across their 1 million workers.

Small businesses face big challenges.

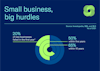

Once small businesses get off the ground, they must fight to stay airborne. Small businesses must build brand recognition and consumer trust while simultaneously competing for market demand, employees, and funding. Data shows that 20% of small businesses fail in their first year, and 65% fail within 10 years.

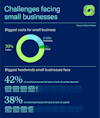

Data shows that lack of market demand and lack of capital are two of the biggest challenges that small business owners face in keeping their doors open. On top of that, navigating the current economic landscape, attracting and retaining talent, and having resilience after unplanned crises or natural disasters are also part of the current reality of being a successful small business owner.

Small businesses with the highest success rate:

- Finance

- Insurance

- Real Estate

Many small businesses are self-funded.

Capital is one of the strongest headwinds facing small businesses. The smallest businesses (0-4 employees) are most likely to use personal savings to finance their business. Larger small businesses (5 – 500 employees) still tap into personal savings, but are more likely to rely on credit cards and local banks and credit unions to fund their operations.

- 33%Businesses launched with less than $5k

- 58%Businesses launched with less than $25k

Small business owners have indicated that financing applications are time-consuming, there is little information available on sources of capital, and that they simply do not qualify for a loan as the most significant barriers to securing financing.

Small businesses are struggling to find workers.

The labor shortage is another headwind small business leaders are facing. There are currently 9.6 million open jobs in the U.S., but only 5.8 million unemployed workers to fill them.

Forty-one percent of small business leaders have indicated trouble filling job vacancies and over 90% have struggled to find qualified applicants. The highest concentration of small business employees are in education and health services, professional and business services, wholesale and retail trade, manufacturing, and leisure and hospitality. These same industries are some the most severely impacted by labor shortages—and small business employers are feeling the pressure.

Learn more about labor shortages in the America Works Data Center, capturing the current state of the U.S. workforce.

Featured Article

Small businesses are in good health. They fear the economy is not.

Despite the majority of small business owners reporting that their business is in good health, they remain concerned about the nation’s broader economic outlook, according to the Q2 2023 MetLife and U.S. Chamber Small Business Index. Just 24% of small business owners say that the U.S. economy is in good health. Slightly more (30%) say their local economy is in good health.

- 60%Small business owners who say their business is in good health

- 63%Small business owners who say they are comfortable with their cash flow

In the Q1 survey, the overall Small Business Index score dropped slightly to 60 from 62.1 as small business owners’ outlook on the national economy weakened. They are not alone in their concern. According to the CEO Confidence Index, CEOs of larger companies’ confidence dropped slightly to 6.1 out of 10 in March 2023 after hovering around 6.3 earlier in the year.

How the U.S. Chamber supports small business.

The U.S. Chamber has a longstanding commitment to supporting and advocating for small businesses. We work every day to give small businesses a big voice in Washington, connecting entrepreneurs and federal officials and advocating for policies that help them grow rather than holding them back.

Our Small Business Council is made up of 100 small business owners from across the country that steer our work in fighting for policies that keep Main Street businesses thriving and regularly visit Capitol Hill.

Since 2017, we have partnered with MetLife to survey small businesses on a quarterly basis for the Small Business Index, which provides valuable insights on current challenges and opportunities for small business that inform our advocacy in Congress.

Through our small business platform CO—, which helps almost 20,000 businesses every day and had more than six million site visits last year alone, we are equipping small businesses with the tools and insights they need to ensure their own resilience in the face of any challenge.

Learn more about the U.S. Chamber small business work here.

Looking for the latest small business outlook?

Every week the U.S. Chamber's Vice President of Small Business Policy summarizes the latest data and what it means for the health of America's small businesses.

About the authors

Stephanie Ferguson